What is Scalping in Forex: A Comprehensive Guide to Profitable Trading

Introduction

In the world of forex trading, there are various strategies that traders employ to maximize their profits. One such strategy is scalping. In this article, we will delve into the concept of scalping in forex, its techniques, benefits, risks, and how to implement it effectively. Whether you’re a seasoned trader looking to explore new trading methods or a beginner curious about different strategies, this guide will provide you with valuable insights into the world of scalping.

What is Scalping in Forex?

Scalping in forex refers to a trading strategy where traders aim to make quick profits by entering and exiting trades within a short period. The objective of scalping is to capitalize on small price movements, usually targeting a few pips at a time. Scalpers often execute multiple trades throughout a trading session, relying on the frequent fluctuations in the market to generate profits.

Scalping is known for its fast-paced nature and requires traders to be highly attentive to the market. It requires quick decision-making skills and a disciplined approach to managing risks. Successful scalping demands a deep understanding of technical analysis, chart patterns, and market indicators to identify favorable entry and exit points.

Advantages of Scalping in Forex

1. Quick Profits

Scalping offers the opportunity to generate profits in a short amount of time. By targeting small price movements, scalpers can accumulate multiple small gains, which can add up to substantial profits over time. This strategy appeals to traders who prefer a more active and fast-paced trading style.

2. Reduced Exposure to Market Risks

Since scalpers hold trades for a brief duration, they are exposed to the market for a relatively short period. This reduces the risk of adverse events, such as unexpected news or economic indicators, negatively impacting their trades. Scalping allows traders to exit positions quickly, minimizing the potential for significant losses.

3. Enhanced Trading Discipline

Scalping requires traders to adhere to strict trading plans and disciplined risk management. The fast-paced nature of scalping necessitates quick decision-making and rapid execution. Traders need to have a well-defined strategy in place, including predetermined entry and exit points, to ensure consistency and avoid impulsive trading.

Risks Associated with Scalping

1. Increased Trading Costs

Scalping involves executing a high volume of trades, which can result in increased trading costs. Traders need to consider spreads, commissions, and other transaction fees, as these expenses can eat into their profits. It is crucial to choose a broker with competitive pricing and tight spreads to minimize trading costs.

2. Time and Effort Intensive

Scalping requires constant monitoring of the market and active participation in trading. Traders need to dedicate significant time and effort to identify potential opportunities, analyze price movements, and execute trades swiftly. It can be mentally and physically demanding, especially during volatile market conditions.

3. Emotional Stress

The fast-paced nature of scalping can induce emotional stress in traders. Quick decision-making and rapid execution can lead to heightened levels of anxiety and pressure. Traders need to develop strong emotional resilience and discipline to overcome the psychological challenges associated with scalping.

Techniques for Effective Scalping

1. Short-Term Timeframes

Scalpers primarily focus on short-term timeframes, such as one-minute or five-minute charts. These shorter intervals provide more frequent trading opportunities, allowing scalpers to capitalize on small price movements.

2. Technical Analysis

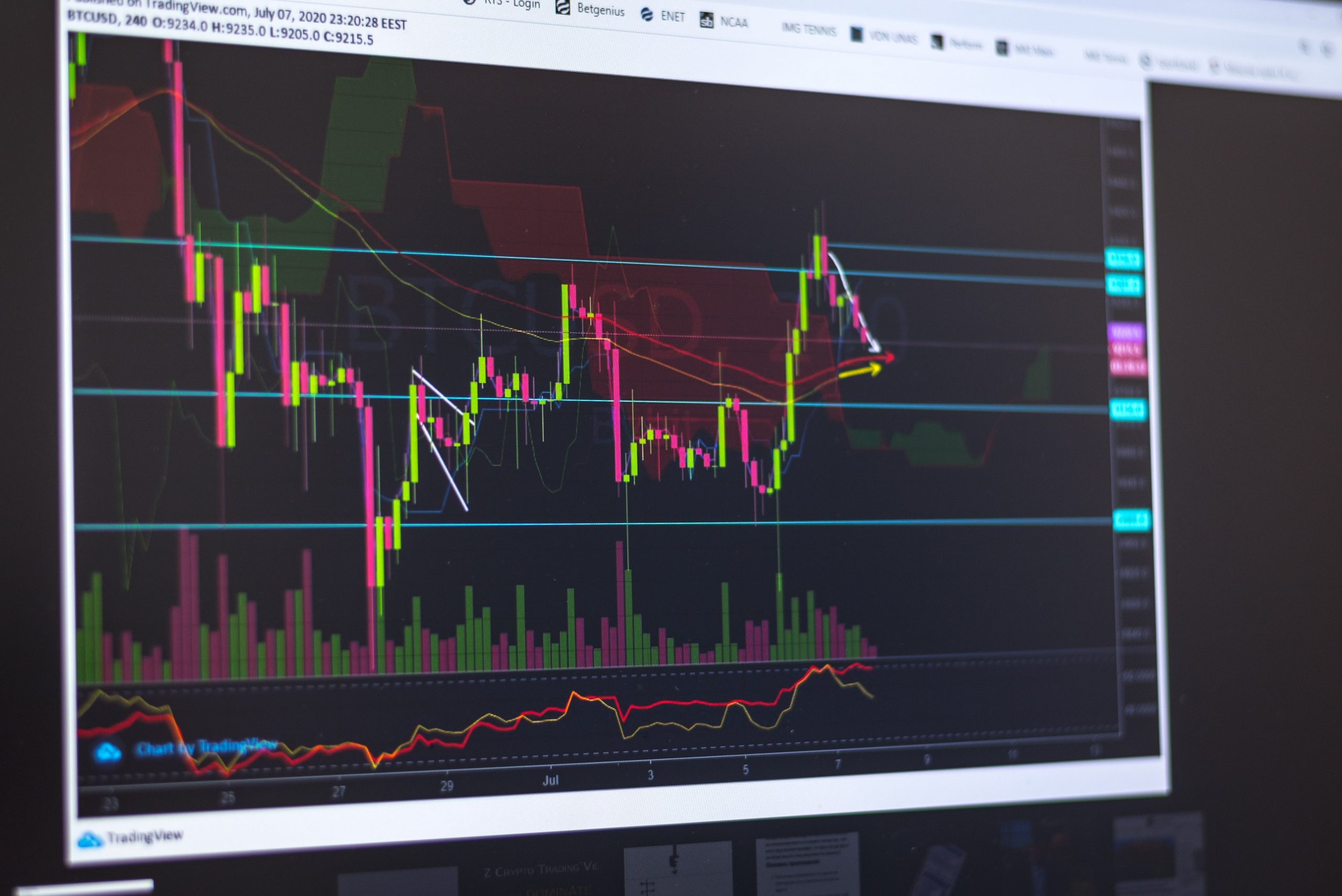

Technical analysis plays a crucial role in scalping. Traders utilize various technical indicators, such as moving averages, oscillators, and support and resistance levels, to identify potential entry and exit points. Chart patterns, candlestick formations, and trend analysis are also essential tools for scalpers.

3. Tight Stop Loss and Take Profit Levels

To manage risks effectively, scalpers set tight stop loss and take profit levels. Since the profit targets are small, it is essential to exit trades promptly when the desired profit is achieved or cut losses when the market moves against the trade. Implementing a sound risk management strategy is vital for long-term success.

FAQs about Scalping in Forex

Q1. Is scalping suitable for beginners in forex trading?

Yes, scalping can be suitable for beginners; however, it requires a solid understanding of technical analysis, risk management, and the ability to handle the fast-paced nature of scalping. Beginners should start by practicing on a demo account and gradually transition to real trading once they have gained sufficient experience and confidence.

Q2. How much capital is required for scalping?

The capital required for scalping varies depending on the trader’s risk appetite, trading style, and the currency pairs being traded. It is recommended to start with a sufficient amount of capital to accommodate potential losses and cover trading costs. Traders should avoid risking a significant portion of their capital on individual trades.

Q3. Are there any specific currency pairs suitable for scalping?

Scalping can be applied to any currency pair; however, traders often prefer highly liquid pairs with tight spreads, such as EUR/USD, GBP/USD, or USD/JPY. These pairs offer better trading conditions and narrower spreads, which are favorable for scalping strategies.

Q4. Can automated trading systems be used for scalping?

Yes, automated trading systems, also known as expert advisors or EAs, can be used for scalping. EAs can help traders automate their trading strategies and execute trades based on predefined rules. It is important to thoroughly test and optimize any scalping EA before deploying it in live trading.

Q5. What are the recommended trading hours for scalping?

Scalping can be done during active market hours when there is sufficient liquidity and price volatility. Traders often focus on the opening hours of major trading sessions, such as the London or New York session overlaps, as these periods tend to have increased trading activity.

Q6. How can I manage the psychological challenges associated with scalping?

Managing the psychological challenges of scalping requires developing a strong trading mindset. Traders should practice self-discipline, patience, and emotional control. Regular breaks, proper risk management, and maintaining realistic expectations are also crucial for long-term success in scalping.

Conclusion

Scalping in forex offers an exciting opportunity for traders to generate quick profits by capitalizing on small price movements. However, it requires a high level of skill, discipline, and the ability to manage risks effectively. By understanding the techniques, advantages, and risks associated with scalping, traders can make informed decisions and develop profitable strategies. Remember to practice on demo accounts, continuously educate yourself, and stay updated with market trends to enhance your scalping skills. Happy trading!