Advanced market timing: techniques for entering and exiting trades

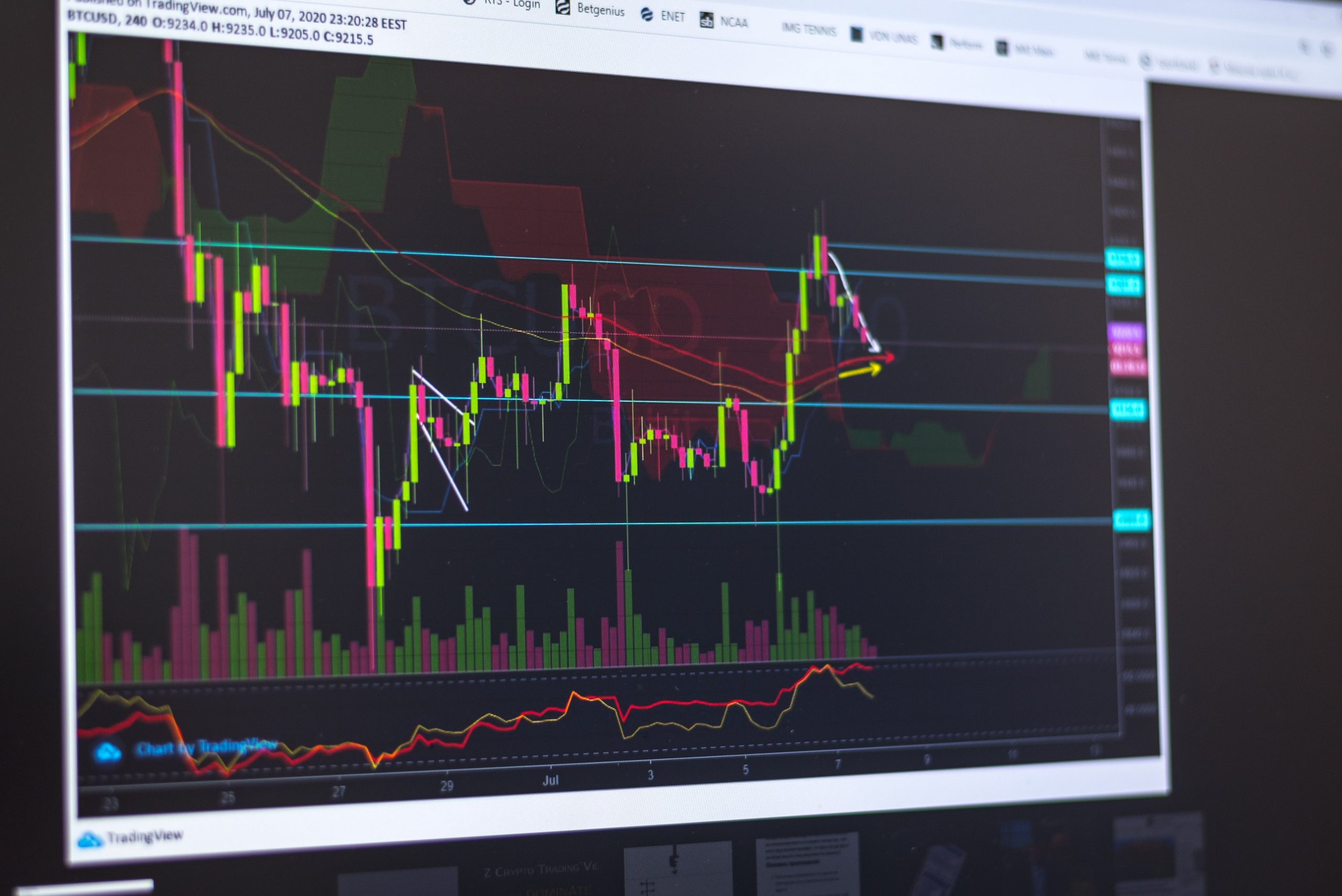

Market timing is a critical skill that sets seasoned traders apart. It involves identifying optimal entry and exit points in a trade to maximise profit potential and mitigate risk. Advanced market timing requires a deep understanding of technical indicators, chart patterns, and the broader market context.

This article will examine some advanced techniques for market timing, providing traders with valuable insights on refining their entry and exit strategies. By examining concepts such as Fibonacci retracements, trend analysis, candlestick patterns, volatility indicators, and news catalysts, we aim to equip traders with the knowledge and tools needed to navigate the intricacies of market timing.

Fibonacci retracements: Riding the waves of price corrections

Fibonacci retracements are a powerful tool for identifying potential reversal levels in a price trend. Derived from the Fibonacci sequence, these retracement levels (38.2%, 50%, and 61.8%) are significant support or resistance areas. Traders use them to gauge potential areas of price correction before the prevailing trend resumes.

When a stock uptrend, traders look for potential entry points near Fibonacci support levels. They also seek exit or shorting opportunities near Fibonacci resistance levels in a downtrend. This technique helps traders align their trades with price movements’ natural ebb and flow. Combining Fibonacci retracements with other technical indicators and chart patterns can further enhance the precision of market timing decisions.

Trend analysis: Riding the wave of momentum

Trend analysis involves identifying the prevailing direction of a stock’s price movement. Traders can utilise tools like moving averages, trendlines, and trend indicators to assess the strength and direction of a trend. Understanding the trend is crucial for effective market timing, as it helps traders align their trades with the dominant market sentiment.

For example, during an uptrend, traders may look for opportunities to enter long positions, aiming to ride the upward momentum. In contrast, during a downtrend, they may consider shorting or exiting long positions to capitalise on potential price declines. Combining trend analysis with other technical and fundamental factors allows traders to make more informed decisions about when to enter or exit stocks trades.

Candlestick patterns: Decoding price action signals

Candlestick patterns offer valuable insights into market sentiment and potential trend reversals. Patterns like the doji, engulfing, and hammer patterns provide visual cues about the balance of power between buyers and sellers. Traders use these patterns to anticipate shifts in price direction.

For example, a bullish engulfing pattern, where a larger up candle follows a small down candle, may signal a potential bullish reversal. Conversely, a bearish engulfing pattern could indicate a potential downtrend reversal. Traders must combine candlestick patterns with other technical indicators and context from the broader market to effectively validate their market timing decisions.

Volatility indicators: Navigating market swings

Volatility indicators, such as the Average True Range (ATR) and Bollinger Bands, provide insights into the level of market fluctuation. High volatility indicates rapid and significant price movements, while low volatility suggests more stable and predictable price action.

Traders can use volatility indicators to adjust their market timing strategies accordingly. In periods of high volatility, they may tighten stop-loss levels to protect profits or reduce position sizes to manage risk. During periods of low volatility, traders may consider expanding their profit targets to capture potential more significant moves. Understanding and adapting to market volatility is crucial for optimising market timing strategies.

News catalysts: Navigating fundamental drivers

News events and economic releases can have a profound impact on stock prices. Traders must stay informed about scheduled announcements like earnings reports, economic indicators, and geopolitical events. These catalysts can create sudden shifts in market sentiment and price direction.

For instance, a positive earnings surprise or a robust economic report may lead to a surge in stock prices. Conversely, negative news can trigger sharp declines. Traders can incorporate news calendars and event trackers into their market timing strategies to effectively anticipate and react to these catalysts.

Seasonal and calendar-based trading: Exploiting patterns

Seasonal and calendar-based trading involves identifying recurring patterns and trends at specific times of the year. This approach recognizes that certain industries or stocks may experience heightened activity or performance during particular seasons. For example, retailers tend to see increased sales leading up to holidays like Christmas, while seasonal changes may influence energy stocks in demand for heating or cooling.

Traders utilising seasonal strategies analyse historical data to identify these patterns and align their trades accordingly. By understanding the seasonal tendencies of specific sectors or stocks, traders can optimise their market timing to capitalise on anticipated price movements. However, it’s essential to supplement seasonal analysis with other technical and fundamental factors to validate trading decisions effectively.

All things considered

Advanced market timing is a skill that requires a nuanced understanding of technical indicators, chart patterns, and fundamental drivers. By employing techniques like Fibonacci retracements, trend analysis, candlestick patterns, volatility indicators, and staying informed about news catalysts, traders can rapidly enhance their ability to enter and exit trades. It’s crucial for traders to continuously refine their market timing strategies and adapt to changing market conditions. Potentially successful market timing is not about perfection but consistently making well-informed decisions that align with your trading goals and risk tolerance.

This article offers a well-rounded view of the subject matter. ❤️