What Is Scalping and Hedging in Forex?

Forex trading encompasses various strategies and techniques to capitalize on price movements and manage risk effectively. Two popular strategies employed by forex traders are scalping and hedging. In this article, we will explore what scalping and hedging are, how they work, and their benefits and considerations.

1. Introduction

Scalping and hedging are distinct trading strategies used in forex markets. While both aim to generate profits, they differ in their approach and objectives. Understanding the principles behind scalping and hedging is crucial for forex traders seeking to diversify their trading strategies.

2. Understanding Scalping

Scalping is a short-term trading strategy that aims to profit from small price movements. Scalpers enter and exit trades swiftly, often within minutes or even seconds. The primary goal of scalping is to capture small increments of price fluctuation multiple times throughout a trading session.

3. How Scalping Works

3.1. Scalping Strategy

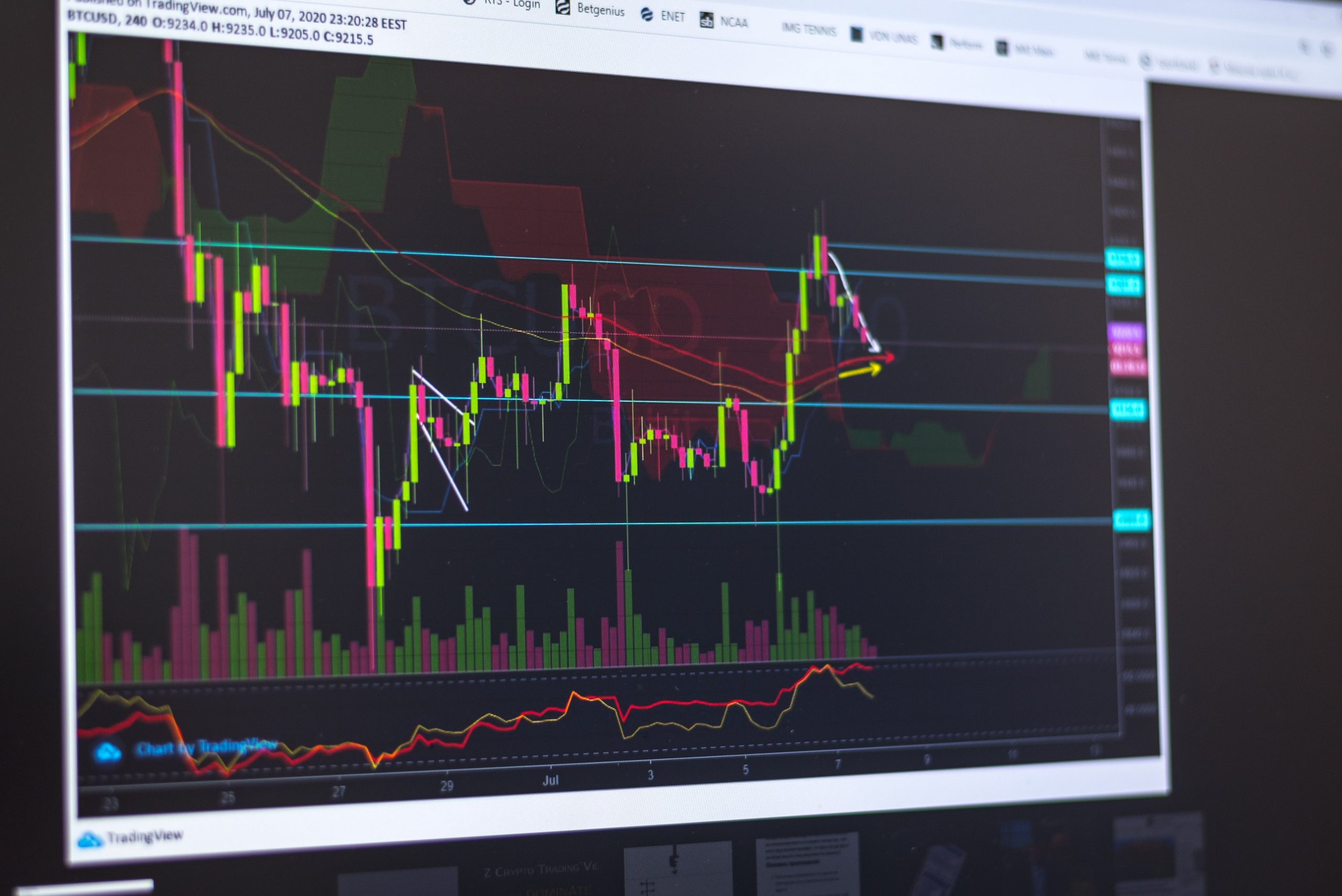

Scalpers employ various strategies to identify short-term opportunities in the market. They rely on technical indicators, chart patterns, and market depth analysis to make quick trading decisions. Scalpers often target liquid currency pairs and focus on capturing small profits from each trade while managing risk tightly.

3.2. Scalping Techniques

Scalpers use different techniques to execute their trades effectively. These techniques include market orders, limit orders, and stop orders. Market orders allow for instant execution at the prevailing market price. Limit orders are used to enter or exit trades at specific price levels, while stop orders are utilized to manage potential losses.

4. Understanding Hedging

Hedging is a risk management strategy employed by forex traders to protect against adverse price movements. It involves opening additional positions to offset potential losses in existing positions. The primary objective of hedging is to reduce or eliminate the impact of unfavorable market conditions on a trader’s overall portfolio.

5. How Hedging Works

5.1. Hedging Strategy

Hedging involves opening positions in opposite directions to mitigate potential losses. For example, if a trader has a long position on a currency pair, they can open a corresponding short position to hedge against downside risk. Hedging can be done using different instruments, such as futures contracts or options.

5.2. Hedging Techniques

Traders utilize various techniques to implement hedging strategies effectively. These techniques include simple hedging, where equal and opposite positions are opened, and complex hedging, which involves using multiple correlated or negatively correlated instruments to offset risk. The choice of hedging technique depends on the trader’s risk tolerance and market conditions.

6. Benefits of Scalping and Hedging

Both scalping and hedging strategies offer specific benefits to forex traders:

Scalping Benefits:

- Potential for quick profits from small price movements.

- Increased trading opportunities throughout the trading session.

- Ability to capitalize on short-term market inefficiencies.

Hedging Benefits:

- Protection against adverse price movements.

- Reduction of overall portfolio risk.

- Flexibility in managing exposure to market volatility.

7. Considerations for Scalping and Hedging

Traders should consider the following factors when employing scalping and hedging strategies:

7.1. Time Commitment

Scalping requires active monitoring of the market and quick decision-making. Traders engaging in scalping should be prepared to dedicate sufficient time and attention to execute trades effectively. On the other hand, hedging strategies may require longer-term commitment, as positions are held to offset potential losses.

7.2. Risk Management

Both scalping and hedging strategies involve managing risk. Traders should carefully assess the potential risks associated with each strategy and implement appropriate risk management techniques, such as setting stop-loss orders and position sizing.

7.3. Regulatory Considerations

Some regulatory authorities impose restrictions on scalping and hedging activities. Traders should familiarize themselves with the regulations in their jurisdiction and ensure compliance with any applicable rules or limitations imposed by brokers or regulatory bodies.

8. Conclusion

Scalping and hedging are distinct trading strategies used in forex markets. Scalping aims to capture small price movements for quick profits, while hedging focuses on managing risk by offsetting potential losses. Both strategies offer unique benefits and considerations. Traders should carefully evaluate their trading objectives, risk tolerance, and market conditions to determine which strategy aligns best with their goals.

9. FAQs

9.1. Is scalping or hedging more suitable for beginners?

Scalping and hedging require different skill sets and approaches. Beginners are advised to start with a solid foundation in forex trading basics and gradually explore both strategies. It is essential to understand the risks and challenges associated with each strategy before implementing them.

9.2. Are there any restrictions on scalping and hedging imposed by brokers?

Some brokers may have specific policies or restrictions on scalping and hedging activities. Traders should review the terms and conditions provided by their brokers and choose a broker that aligns with their preferred trading strategies.

9.3. Do scalping and hedging guarantee profits?

Neither scalping nor hedging guarantees profits. Both strategies involve risks, and traders should be prepared to incur losses. Success in forex trading depends on a combination of skill, knowledge, market conditions, and effective risk management.

9.4. Can scalping and hedging be combined?

Scalping and hedging can be combined, but it requires careful planning and consideration. Traders should assess the compatibility of the two strategies, taking into account their trading style, risk tolerance, and market conditions.

9.5. Are there any alternatives to scalping and hedging?

Yes, there are alternative trading strategies in forex markets, such as swing trading, day trading, and position trading. Traders can explore these strategies to find an approach that aligns with their trading goals and preferences.