Choosing the Right Day-Trading Software

For anyone looking to start day trading as a way of potentially increasing their wealth, it is essential to understand how the process works before jumping in. It would help if you had a firm grasp on the basics of day trading, and picking the right software can be equally vital for success. Finding trading software that meets all your needs and fits your budget could help ensure your trading business runs smoothly.

Proper research and thought are necessary when selecting day-trading software, as it significantly impacts whether or not you profit from this venture. In this article, we will look at various features and considerations that potential traders should consider when choosing what type of software they want to use for their day trades.

Understand the Different Types of Day-Trading Software

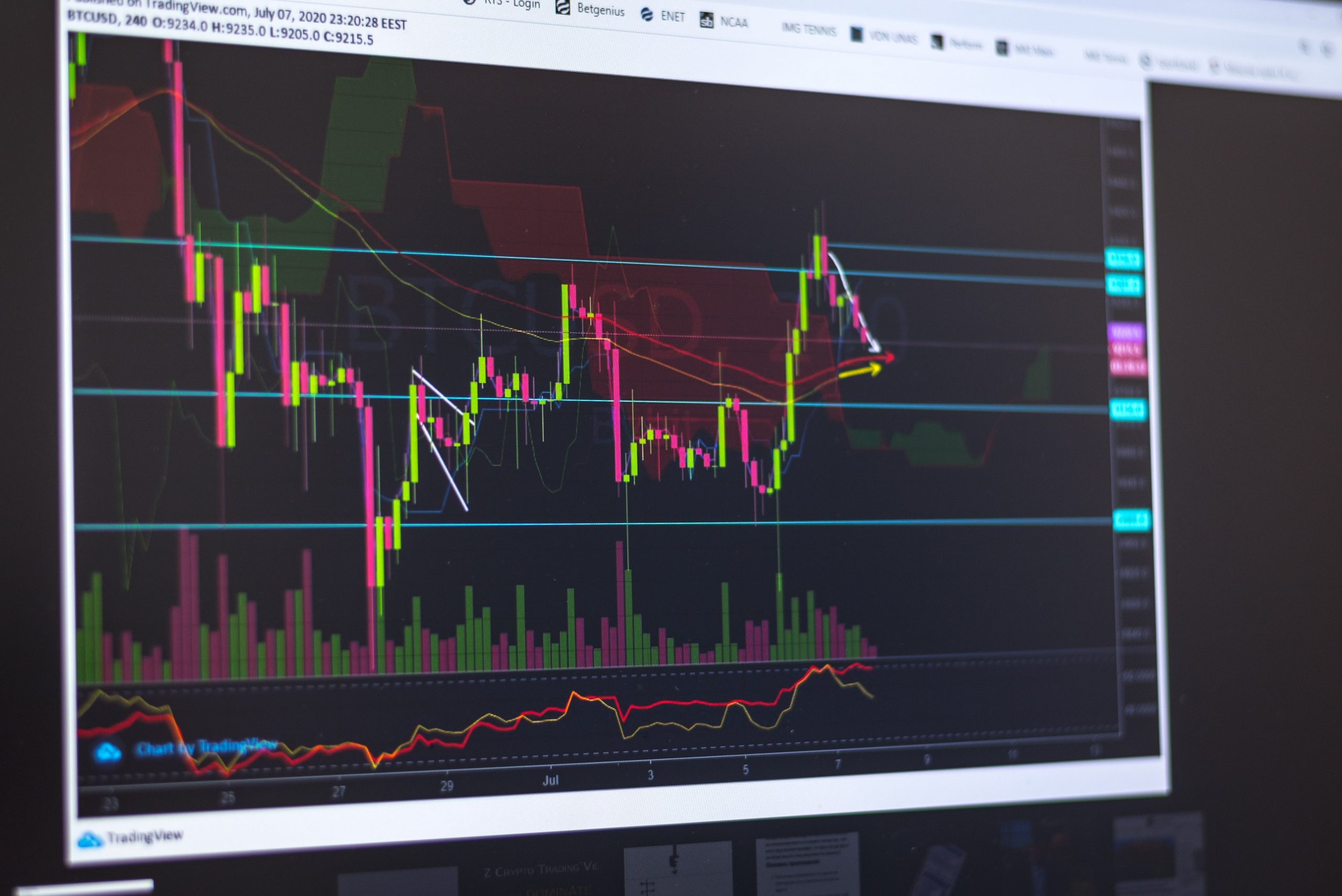

For those interested in day trading, it’s essential to understand the different types of day-trading software available on the market. These software systems are designed to help traders make informed decisions about when to buy and sell stocks, currencies, and other financial instruments. There are many different types of day-trading software, ranging from basic programs that offer only the most basic features to advanced systems that use sophisticated algorithms to analyze data and predict market trends.

Whether you are a beginner or an experienced trader, choosing a day-trading software system that best meets your needs and allows you to achieve your investment goals is essential. By understanding the different types of day-trading software available, you can make a more informed decision and increase your chances of success in the world of day-trading. The best trading software in Australia should have a variety of products that could meet your needs and fit your budget.

Consider your Unique Needs and Goals

When selecting the right day-trading software for your needs, it’s essential to consider your requirements and trading goals. Different day-trading software systems offer different features, so you should think carefully about what information and functionality you need to make profitable trades. For example, a basic system may be more suitable for your needs if you are a beginner trader.

On the other hand, experienced traders may want access to advanced tools such as backtesting capabilities and algorithmic trade execution. Ensure your chosen software meets all your needs and is tailored to your unique trading style.

Research & Compare Software Features

Once you understand the different types of day-trading software on the market and your individual needs, it’s essential to do some research and compare the features offered by different platforms. It will help you ensure you are getting the most out of your trading software in terms of features and cost.

Speaking to other traders using various day-trading software systems is also a good idea. They can provide valuable information about the most accessible and beneficial trade platforms.

Test the Platform’s Usability Before You Commit

Once you have narrowed your options, the next step is to test the various platforms. Most software companies offer demo accounts so potential users can try their platform before purchasing. It will help you get a feel for how the system works and whether it’s easy to use or not.

Additionally, some software providers offer free trial periods, allowing you to test out the platform before committing. It is a beneficial option for beginners as they can become familiar with the trading process using accurate data in a risk-free environment.

Look at Security & Data Protection Protocols

When choosing a day-trading software, it is essential to look at the security and data protection protocols offered. The last thing you want is for your financial data to be compromised or stolen by hackers. Ensure that the platform you choose has measures to protect customer data and ensure secure transactions.

Many platforms provide encryption services to further safeguard against cyber threats. Do your research and ensure that your trading information is as secure as possible with the chosen provider.

Assess the Cost & Subscription Model

The cost of day-trading software can vary significantly, depending on the features offered. Some platforms are free, while others require a monthly subscription or an upfront payment. It is essential to sift through the pricing structure and decide whether you are getting good value for money from the platform you choose.

Some software providers offer discounts for longer-term subscriptions, so it may be worth considering this option to save money. Additionally, ensure that any additional costs associated with the platform are clearly stated before committing.

Conclusion

Day trading can be profitable, but the right software is critical to ensuring success. There are many different types of day-trading software on the market, and it’s essential to understand your individual needs and goals before deciding. By considering the features offered by various platform providers, researching customer reviews, testing demo accounts, and assessing the cost and subscription model, you can make an informed decision about the day-trading software that best suits your needs.